Love this Bacon quote 👆Good morning! In this week’s Dirty Dozen [CHART PACK] we again lay out the bull case for risk assets over the near term. We look at positive breadth thrusts, a GIANT wall of inflows, fund managers raising cash, calendar effects, a bearish setup in a popular growth stock, silver at support, and an international container shipper selling for beans, plus more…

Love this Bacon quote 👆Good morning! In this week’s Dirty Dozen [CHART PACK] we again lay out the bull case for risk assets over the near term. We look at positive breadth thrusts, a GIANT wall of inflows, fund managers raising cash, calendar effects, a bearish setup in a popular growth stock, silver at support, and an international container shipper selling for beans, plus more…

- The SPX hit our 4,800 MM target before year’s end, as expected. I’m now looking for a brief pullback before another run-up. The next target is the big round 5k level. Once we get there we’ll probably see profit takers come in which should slip the SPX into a trading range/pullback for a few months. But who really knows, just gotta play the tape!

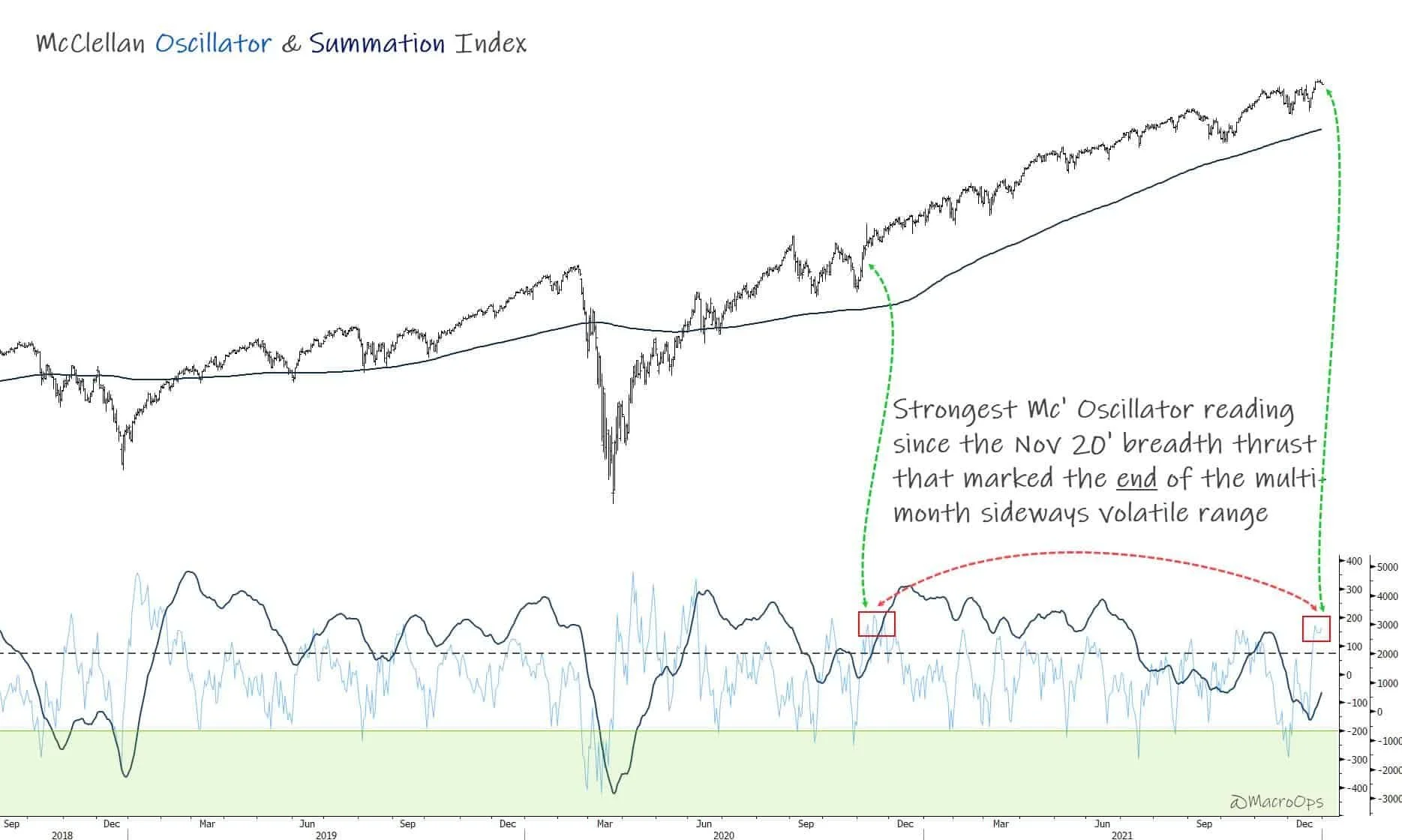

- The McClellan Oscillator jumped to its highest level since the Nov 20’ bull thrust that marked the end of a volatile multi-month sideways range. This is bullish…

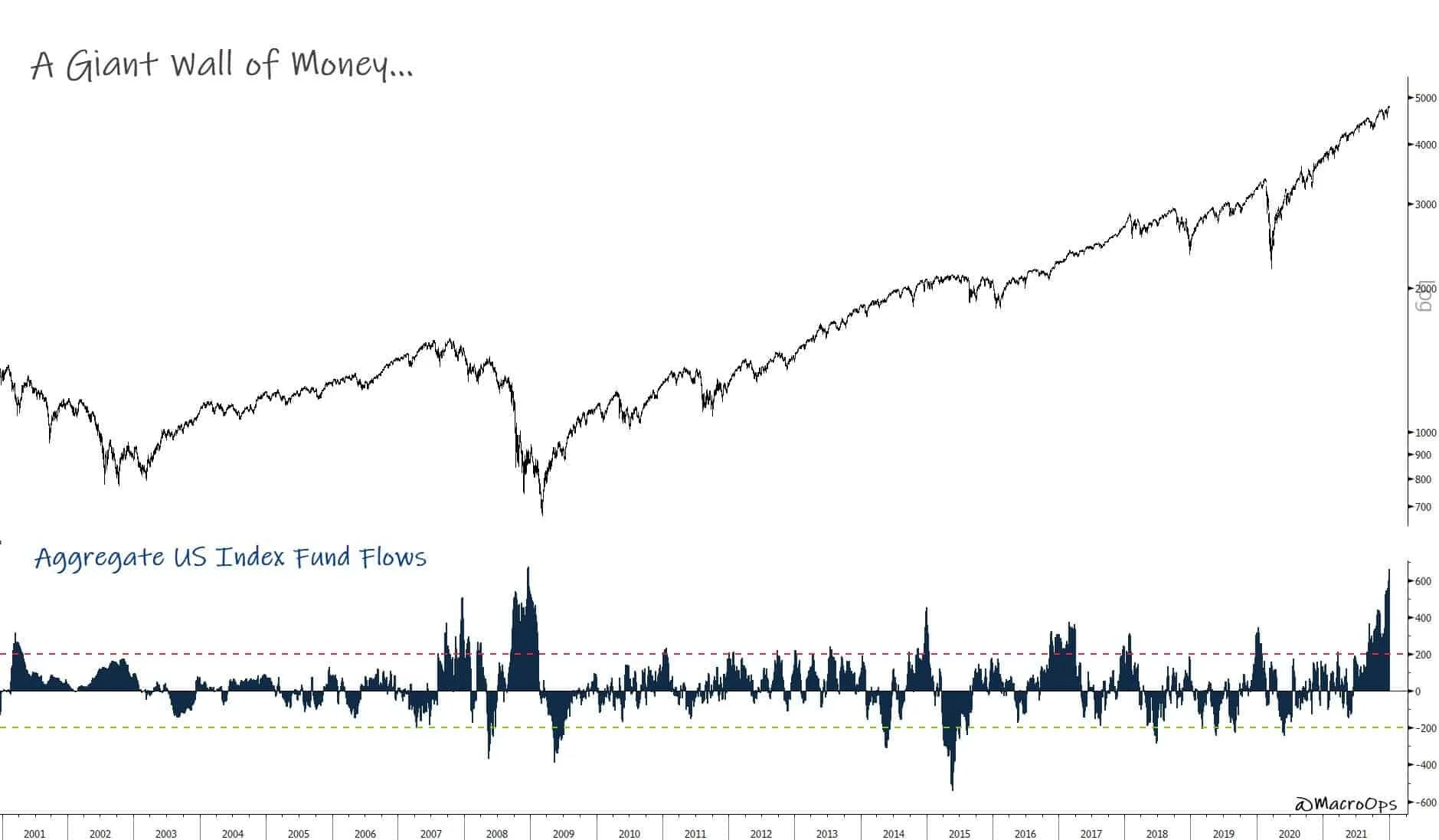

- The wall of money that has flowed into major US Indices over the last couple of months is sure something… Typically you see this type of mass inflows at major bottoms or in the lead up to larger tops.

- These inflows have almost entirely come from the retail crowd over the last 2-years.

- BofA’s December FMS contained a few interesting data points, such as (1) cash holdings surged to 5.1% triggering a contrarian “Buy Signal” (2) yet, just 13% of respondents are UW stocks and (3) only 9% expect bond yields to move lower.

- Here are the standout charts from the report.

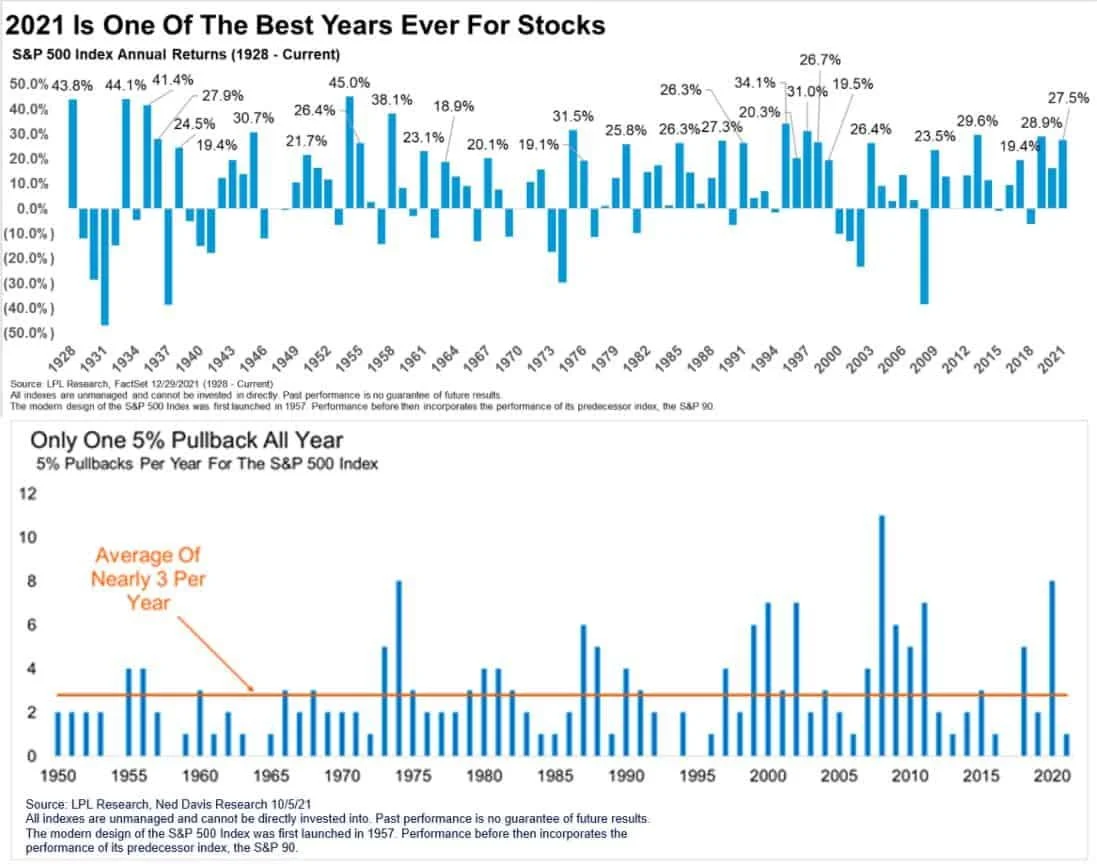

- LPL Research put out a good “Charts of the Year” post which you can find here. They point out that 2021 was one of the best years for stocks on record with a 27% market return and only one 5% pullback all year.

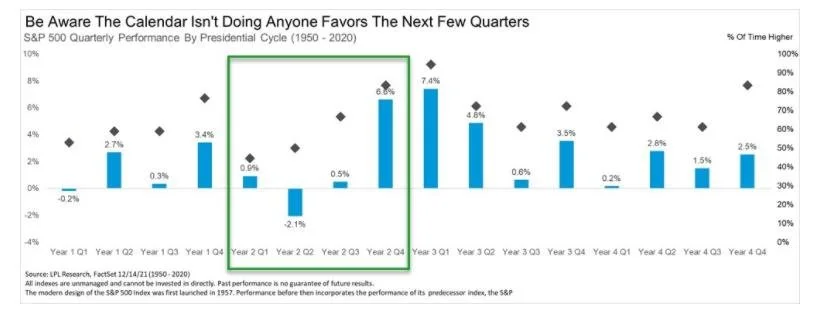

- We should certainly see more volatility this year as we’re past peak liquidity and moving into a global tightening regime. Plus, there are some negative seasonality headwinds coming up. This chart was shared in Jesse Stine’s latest market note, which you can find here.

- Silver held its line on the monthly and miners rebounded off their lower monthly BBs. PMs could be setting up for a year after a sideways 2021.

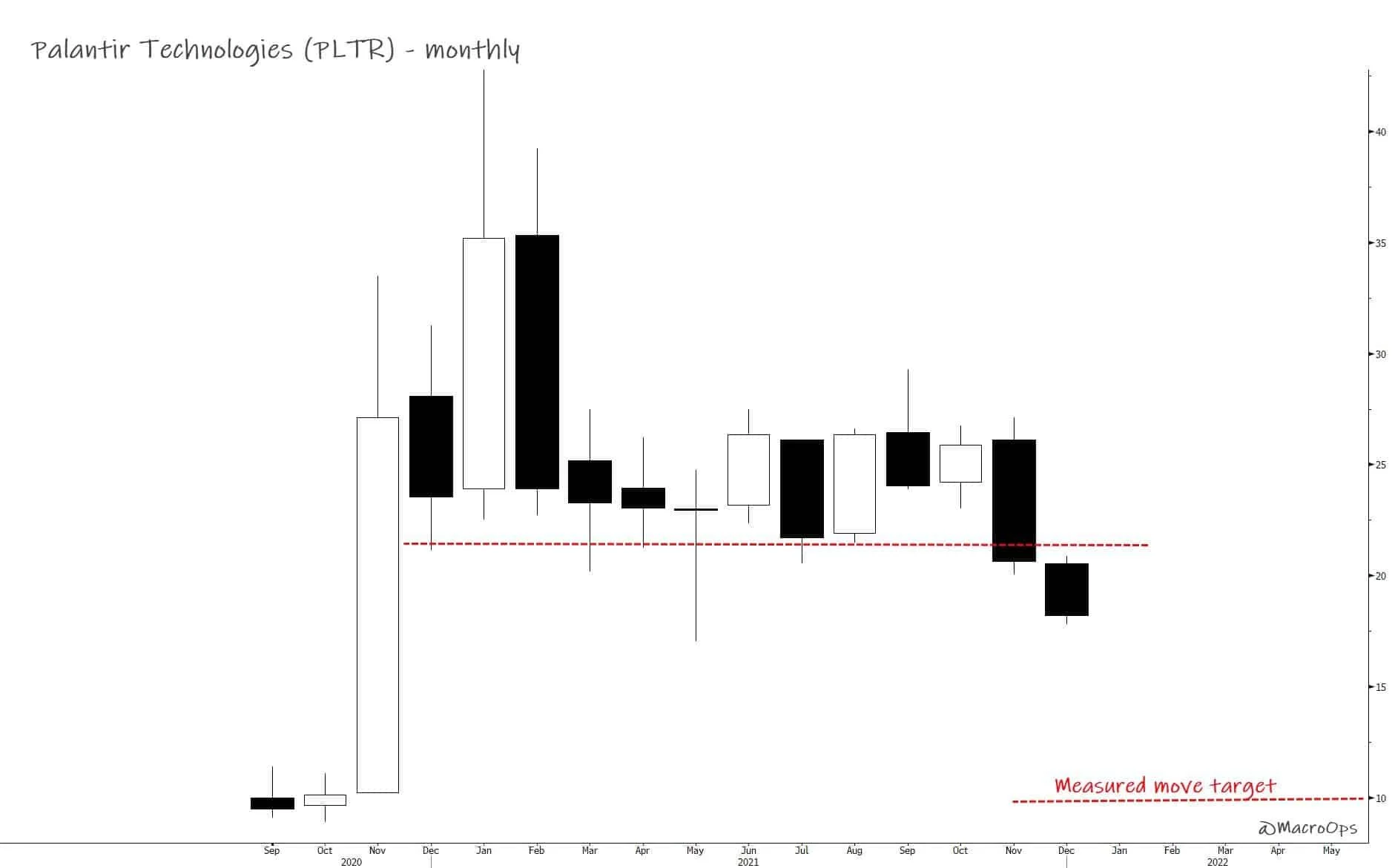

- A former employer of mine, Palantir Technologies, closed near its monthly lows after breaking down from its year-long sideways range. The measured move target is $10 which would make for a full round trip to its IPO price.

- Homebuilder Beazer Homes may be making an attempt to break out from its decade+ long basing pattern. It’s seen a number of consecutive strong positive beats, it’s trading for only 4.8x EV/EBITDA, and is growing both the top and bottom line.

- Here’s a company I’m digging into this week. ZIM Integrated Shipping Services (ZIM). ZIM is a container shipping company based out of Haifa, Israel. I don’t know anything about the name but on the surface, it looks very cheap, it’s seeing strong growth, and its chart is in a clear uptrend.

I’ll be out with a report later this week if there’s anything here.

Thanks for reading.Stay safe out there and keep your head on a swivel.

Thanks for reading.Stay safe out there and keep your head on a swivel.

Leave a Reply